Overview

Splitwise is a financial management app designed to simplify shared expenses and bill-splitting among groups. It helps users track shared expenses, settle debts, and calculate balances within groups like roommates, trips, and outings. A core feature of the app is the “Simplify Debt” function, which reduces the number of transactions necessary between group members.

My Role

UX Researcher

Responsibilities

As a UX Researcher

-

User Interviews

-

Usability Testing

-

Affinity diagramming.

-

Data analysis and design recommendations.

Duration

4 Weeks

Tools Used

-

Figma

-

Google Docs

-

Voice Memos

-

Miro

Research Focus

"Evaluating the Usability and Usefulness of Splitwise for Managing Shared

Expenses Among International Students Living Together"

We want to understand how international students currently use Splitwise and in

what ways they go about managing their shared living expenses.

Research Goal

This research aims to analyze the usability of Splitwise, a mobile application for expense management, by specifically targeting international students who share accommodations. It seeks to determine whether the Splitwise app caters to the needs of its users effectively for shared group expense management and if it is

usable and useful for them. The study also intends to find the main use cases and problems of this particular user group for insights into their needs and behaviors.

Why this App

I chose the Splitwise app for research because it effectively handles real-world financial management issues like expense sharing, debt tracking, and collaborative spending. Its popularity and multi-user interactions provide valuable insights into designing solutions for transparency, fairness, and group dynamics in financial apps. Moreover, studying Splitwise offers opportunities to enhance user experience, accessibility, and trust in complex financial scenarios.

Objectives

Shared Expense management: Establish how intuitive Splitwise is in tracking

shared expenses among international students.

Identify Key Features: Determine the most used features and their value for group expense management.

Explore Challenges: Uncover any usability problems or frustrations that users

encounter.

Free Version Assessment: Assess the level to which the free version supports user requirements and its shortcomings.

Gather Improvement Suggestions: Identify missing features and gather user

suggestions for enhancement.

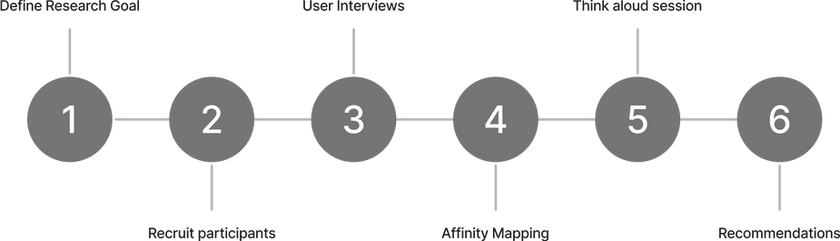

Methods and Analysis

We used a two-step approach combining qualitative surveys and task-based usability testing. First, semi-structured interviews helped us identify key pain points and high-level issues in user satisfaction and feature usability. Based on these insights, we designed specific tasks for a think-aloud usability test, where participants completed actions like adding or settling expenses. This helped us gather quantitative data and uncover hidden usability problems that interviews alone might miss.

-

Semi-Structured Interviews: Conducted exploratory discussions to gain preliminary insights and understand users’ broader experiences, identifying key pain points and usability issues.

-

Think-Aloud Sessions: Designed tasks based on interview findings. Observed participants as they navigated the app, which helped uncover specific navigation challenges and successes.System Usability Scale (SUS) Ratings:

-

SUS questionnaire: To collect quantitative data on overall app usability, complementing the qualitative insights.

Target Users

Target users are international students from a diverse group of different ages,genders, and educational backgrounds.Key highlights of this study are as follows:

● Age: The age range is from 22 to 28 years, indicating young adults. Thisdemographic group covers students who have shared expenses and hencewould be very potential users for any expense-splitting applications, includingSplitwise.

● Education Background: Some users are international students listed in higherdegree programs such as PhDs and master's programs. It could be assumedthat their financial management needs may differ, especially in group living orshared expenses situations.

● Device Usage: It is noted that 8 users use iOS devices while 4 users useAndroid.

User Interviews (Qualitative data)

We carefully recruited 12 participants with varying levels of experience using the Splitwise app for our user interviews. The aim was to understand their experiences managing shared living expenses through the app and to identify any challenges or issues they encountered in the process.

After conducting the user interviews, we collected the responses and used affinity diagramming to identify common themes and patterns from the insights gathered.

Analysing the data

Affinity Diagramming

Diagram 1: A visual representation of the affinity mapping

Positive Points:

-

Overall App Perception: Most participants have a positive opinion of the app and find it useful for managing shared group expenses.

-

Favorite Features: Adding a group expense, splitting them among members, and the "simplify debt" feature stood out as favorites among users.

Common Pain Points:

-

Onboarding Experience: Splitwise needs a more effective onboarding process to introduce app features efficiently to novice users.

-

Confusing User Interface: The UI for adding and sharing group expenses was reported to be unclear and confusing for multiple participants.

-

Simplify Debt Confusion: Users were uncertain about the "simplify debt" feature, not knowing if it was active, who activated it, and being surprised when group members did not owe them money due to this feature.

-

Free Version Limitations: Dissatisfaction with limitations in the free version, such as ads and restricted transaction counts, was commonly expressed.

-

Difficulty Managing Non-Group Expenses: Participants reported challenges in finding and settling non-group expenses efficiently.

Based on insights from the interviews, we then conducted a detailed usability assessment using a task-based think-aloud protocol. The interview findings guided the creation of specific tasks, targeting areas where users faced challenges or confusion, to evaluate the app’s usability in real-world scenarios.

Think aloud session

Overview of Participants

A total of 12 participants, aged between 22 - 28, were recruited for this study. All participantsare international students currently enrolled in a PhD or Master’s program in the US. They reported being regular users of Splitwise, primarily utilizing the app to manage sharedexpenses with their roommates.

Tasks for testing

The study goal was to evaluate the ease of use and awareness of the core features ofSplitwise among international students.

Task 1: Create a new group in Splitwise for your housemates and invite them to join the group

Follow up question: How easy or difficult was it to add and manage shared living expenses? Rate between 1 to 5, 1 being difficult and 5 being easy.

Task 2: Add a shared grocery expense to the Splitwise app and assign it to housemates.

Follow up question: How easy or difficult was it to complete the task? Rate between 1 to 5, 1 being difficult and 5 being easy

Task 3: Find and enable the simplified debt feature for the newly created group

Follow up question 1: How easy or difficult was it to add and manage shared living expenses? Rate between 1 to 5, 1 being difficult and 5 being easy

Follow up question 2: Were you aware of this feature?Do you know what is the use of this feature?

Findings from the testing

For Task 1

11/12

Users Completed the task successfully

4.4/5

Average ease of use rating as given by the users

Postive :

Test participants found creating a new group in Splitwise to be straightforward and easy. Many users were able to complete the task effortlessly due to their familiarity with the feature from frequent use, making the process second nature to them.

Areas for improvement:

-

During the testing, it was observed that 25% of users mistakenly clicked on the plus button in the navigation bar—intended for adding a new expense—when attempting to create a new group.

-

Despite the high completion rate for creating a new group, 58% of users suggested improving the user interface to make it more intuitive and clearer. They expressed that while they could eventually complete the task, the current design was somewhat confusing and led to uncertainty, indicating that a more streamlined and intuitive approach could enhance the overall experience

For Task 2

09/12

Users Completed the task successfully

4.3/5

Average ease of use rating as given by the users

Postive :

Test particpants were easily able to complete this task.

Areas for improvement:

-

During testing, 3 out of the 12 participants experienced confusion when attempting to add a member to a newly created group. Although they eventually completed the task, they were dissatisfied with the time it took to figure out the correct method. As a result, they rated the task's ease of use below 3 out of 5, indicating that it was not easily usable and, therefore, the task was marked as failed.

For Task 3

07/12

Users Completed the task successfully

3.8/5

Average ease of use rating as given by the users

05/12

Users were not aware of the feature and its use

Areas for improvement:

-

The task achieved only a 58% completion rate, which is significantly lower than that of the other two tasks.

-

Both novice and experienced users reported difficulty locating the "Simplify Debt" feature in the app, and many expressed confusion about how the feature operates, as they do not understand the underlying logic.

-

As a result, this task received a relatively low average usability score of 3.8 from the participants.

Other Common Findings

Users found the unpredictability and length of ads prompting premium subscriptionsfrustrating, often waiting impatiently for them to end. This, along with the limitations of thefree version, reduced the app's overall value.There was also confusion around how money is split—whether equally, unequally, or byratio—making it hard for users to understand how these features worked. Although manyusers found the "Simplified Debts" feature, most weren’t sure what it did or how it impactedtheir expenses, especially when it became unclear who had paid and who owed money.

Recommendations

-

Simplify UI for Adding Groups and Expenses

-

Streamline the interface to enhance user experience.

-

-

Enhance Discoverability of Key Features

-

Make the "Simplified Debt" and "Settle Up" features more visible and accessible.

-

Users reported difficulty navigating these features, often feeling confused about their location and function.

-

-

Implement In-App Tooltips

-

Provide brief explanations for features like "Simplified Debt" to clarify their purpose before activation.

-

-

Add Visual Cues for Active Features

-

Introduce indicators on the group dashboard when features like "Simplified Debt" are active to improve user awareness and understanding.

-

-

Limit or Reposition Ads

-

Reduce the frequency of ads or reposition them to minimize disruption during key interactions.

-

A consistent placement for ads could help users adapt to their presence, as users expressed frustration with their unpredictability.

-

-

Improve Member Addition Process

-

Synchronize email and contact-based additions to reduce confusion.

-

Users often mistakenly believe splits were applied correctly, only to discover discrepancies later.

-

-

Make Icons More Intuitive

-

Clarify the function of icons, such as the plus icon, to prevent misinterpretation and enhance efficiency in user interactions.

-